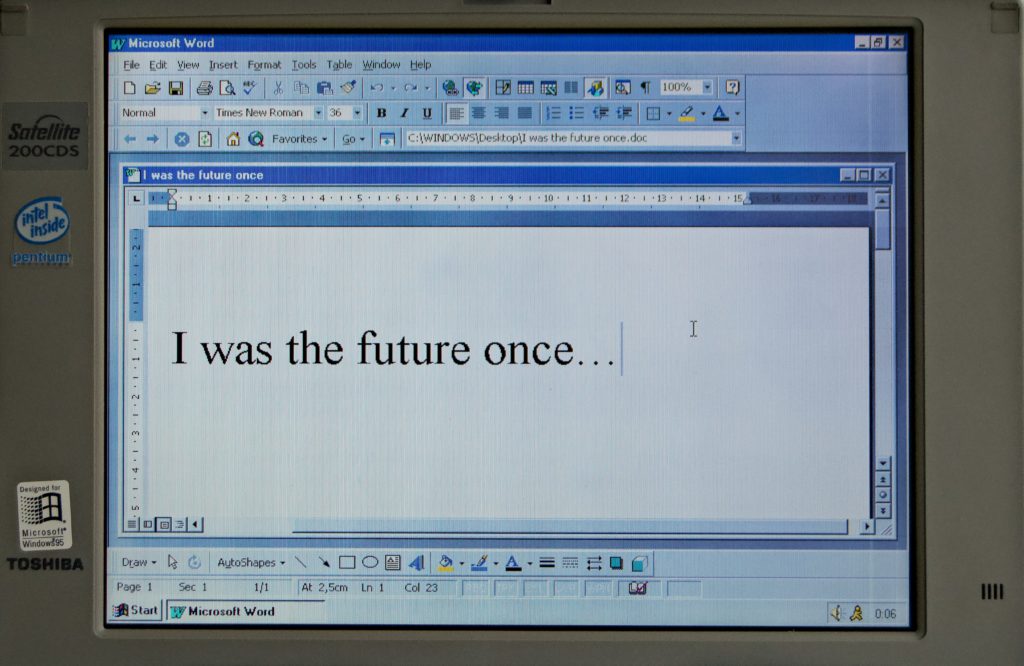

It’s fascinating to watch a Narrative change rapidly in real time.

Microsoft (MSFT) beat expectations on earnings per share and the price spiked in after-hours.

But it didn’t last long…

Weak guidance led investors to start doubting the company’s long-term value as an investment.

And a MAJOR tech outage didn’t help matters. (More on that below).

In fact, we’re starting to see a return to some of the market pessimism in the tech sector that looked to be taking over a few weeks ago.

We’ve enjoyed some recent rallies, but that may have simply proven to be the last short-term surge.

However, I think it would be a mistake to give in to any kind of pessimism.

At worst, if we’re about to see a dip, this is a potential buying opportunity.

At best, MSFT and other companies have shown that they are preparing for the future – cutting expenses, changing their marketing strategies, and pouring resources into the fight for AI.

But even the largest corporate titans can’t take on Uncle Sam – something Google is about to learn.

The battlefield is about to change… and the only easy day was yesterday.

Keep Moving,

While many others have joined the TradeCommand Network for $2,997 a year, you can try Chris Hood’s’ strategies for ONLY $97.

WORD ON THE STREET

DOJ vs. Google, MSFT Rises and Falls, New Doomer Joins The Chat

- JP Morgan Chief Strategist Says Fundamentals Are Weak – Marko Kolanovic says that he’s “outright negative” when it comes to the stock market, taking a bearish approach at a time when some investors were starting to gain back some hope. “Fundamentals are deteriorating,” he said. “And the market has been moving up. So that has to clash at some point.” He argues that a recession may be on the way – but investors aren’t taking it seriously enough.

-

MSFT Beats Expectations, Plunges – Microsoft definitely prepared investors for this one. The company confirmed its major investments into OpenAI and managed to beat expectations on earnings per share. It posted $2.32 per share, compared to just under the $2.30 per share that was expected. However, it was down on revenue – and far more importantly, MSFT expressed caution about the future. Business declined in December, and the company said it expects the trend to continue into the next quarter.

-

DOJ May Break Up Google – The Justice Department is suing Google, alleging that it has a monopoly in the online advertising market. The feds said Google “has corrupted legitimate competition in the ad tech industry by engaging in a systematic campaign to seize control of the wide swath of high-tech tools used by publishers, advertisers, and brokers, to facilitate digital advertising.” Eight states – from deep blue California to deep red Tennessee – have also joined the suit.

- Tesla Plans Factory Expansion – While Elon Musk is still fighting a shareholders’ lawsuit and investors are gloomy about the future, TSLA is still thinking big. TSLA is planning on spending an eye-popping $3.6 billion to expand its gigafactory in Nevada. The expansion will add about 3,000 jobs and allow the company to build more Semi electric trucks and battery cells.

HOT SPOTS: What’s Going on in Geopolitics

- China Begins Non-Lethal Assistance To Russia – It’s something we’ve all been waiting for – China is now decisively shifting towards Russia in the world diplomatic conflict. Several Chinese companies are providing non-lethal military support. The report comes from American intelligence. However, the lack of lethal aid at a time when the West is sending tanks to Kyiv shows Beijing is still playing it cautious.

-

Ukraine Holds In Bakhmut – The meat grinder that is Bakhmut keeps turning, with Russia claiming tactical advances and Ukraine boasting that it still has control of the city. The White House says Russia is taking “extraordinarily high” casualties in the fight. The Wagner group is taking the brunt of the assault, with about 40,000 prisoners fighting in the ranks.

-

Natural Gas Prices Surge In China – A natural gas shortage is putting unwelcome pressure on Chinese infrastructure even as the country buckles from the COVID-19 pandemic. Social media, normally closely controlled by the central government, is filled with complaints as ordinary citizens express their frustration. While Europe has experienced a warm winter that blunted Russia’s energy embargo, China is suffering from bitter cold.

CUTTING EDGE: What‘s Happening In Tech

- Space Mining On The Way – Yes, the awesome sci-fi dystopias we all dream of are creeping closer to fruition. AstroForge, a new asteroid-mining company, is planning two missions this year to test its new technology. The target will be platinum, with the first launch scheduled for April 2023 so the company can see if its mining method works on asteroid-like material.

-

Amazon Makes Big Move Into Medicine – Amazon has unveiled “RxPass,” a new service for Prime members. For a flat fee of $5 a month, customers will get as many generic medications as they need. Amazon says the service, which may be expanded later, should cover drugs for about 80 medical conditions.

- MSFT Products Go Down For Thousands – Teams, Outlook, Microsoft 365, and even XBOX were all down for thousands of users yesterday. Incidents occurred around the world, from India to the United Kingdom. Microsoft said it was a “potential networking issue.” Sounds a bit more than just a “potential” issue to me

FOR YOUR CONSIDERATION

“So, I’ll present you with one simple strategy that has served me well for many years. The 60 delta/60 DTE call option.”

Volatility is the name of the game as the market his a turning point – and it’s time to up your arsenal.

In this edition of Hood Talk, Your Options Coach Chris Hood explains one of his patented moves, the 60 delta/60 DTE call option. This is a weapon you’ll definitely want ready to deploy.

Strike first, strike hard, no prisoners.

Enjoying Dawn Report? Learn something, made some money?

SHARE YOUR STORY WITH US OR TELL US HOW TO SERVE YOU BETTER.

Let us know at info@rogueinvesting.com