The gains sometimes come when you least expect it.

Robinhood (HOOD) has been having an absolutely ruinous year. From a high of over $70, it has declined to under $8.00 a share.

However, it spiked yesterday based on a report from Bloomberg that crypto exchange FTX, headed by Sam Bankham-Fried, may be exploring a takeover. Trading was halted.

Yet this wasn’t totally out of the blue. Bankham-Fried took a 7.6% stake in Robinhood last month according to an SEC filing. And he has been taking a leading role in propping up the struggling crypto sector.

One of Bankman-Fried’s firms, Alamedia, is backing Voyager Digital with $500 million.

And FTX is giving BlockFi about $250 million in revolving credit.

For some, this means that Sam Bankham-Fried is the “JP Morgan” of cryptocurrency. Yet the reality is more troubling.

Even during the worst panics, there was little possibility that banks, as such, would stop operating. And during the most recent financial crisis, the government stepped in to bail out Wall Street. “Too big to fail” and all that.

In fact, the outrage that certain Wall Street firms were getting a bailout was one of the reasons cryptocurrency took off… it was one of the main justifications for its existence.

But now crypto is facing an existential test. As our late friend Dr. Kent Moors pointed out almost one year ago, there’s always been some major questions about whether so-called “stablecoins” have sufficient backing. And now, the true test seems at hand, as more political forces mobilize against cryptocurrency.

Are there reasons for optimism? At least three.

First, we’ve been here before with cryptocurrency – and a valuation around $20,000 per BTC would have sounded wildly optimistic not that long ago.

Second, ETH is undergoing improvements that will make its network work more quickly and limit the environmental impact.

Finally, hyperinflation in countries around the world, notably Turkey, means that there is still a role for bitcoin as a store of value.

It just might not be in the United States. Despite inflation, the dollar remains the world’s reserve currency… at least for now.

Don’t miss Mr. X today on whether that will always be true.

Keep Moving,

In this week’s Hood Talk, Chris looks at the market through three time frames – the daily, monthly, and weekly charts.

This isn’t just guesswork, but an analysis using tools that hedge funds are willing to pay millions of dollars to use.

WORD ON THE STREET

Train Derails, Manufacturing Slowdown, Nike Stuns On Earnings

-

Both China And America Show Weakening Manufacturing – Lockdowns in China may be fading away, but that doesn’t matter as orders from American importers have reportedly fallen by between 20% and 30%. But there are also some signs of manufacturing weakening here at home… the Dallas Federal Reserve reported a fall in orders that points to a recession. “The production index, a key measure of state manufacturing conditions, fell from 18.8 to 2.3, reaching its lowest reading since May 2020,” said the Dallas Fed about the situation in Texas.

-

JUST DID IT – As the warrior-poet John Connor said as a child in Terminator 2: Judgment Day, no fate but what we make. Despite slowdowns in China and worries about recession, Nike crushed expectations when it came to fourth-quarter earnings. The key was direct-to-consumer sales. An $18 billion stock buyback also boosted the stock price in after-hours trading.

-

Amtrak Derails After Hitting Truck – At three people are dead after an Amtrak passenger train hit a dump truck. At least 50 injuries have been reported. Initial reports from Amtrak suggest the truck was trying to beat the crossing. The National Transportation Safety Board is sending 14 people to investigate.

-

Coinbase Collapse – Following a downgrade from Goldman Sachs, Coinbase (COIN) lost almost 11%, capping off a ruinous year that has seen the stock lose almost 80%. “We believe Coinbase will need to make substantial reductions in its cost base in order to stem the resulting cash burn as retail trading activity dries up,” wrote analyst William Nance.

HOT SPOTS: What’s Going on in Geopolitics

- Russia Strikes Ukrainian Mall – President Volodymyr Zelenskyy said it was “impossible” to imagine the number of victims following a Russian missile strike against a crowded mall. The attack took place in the city of Kremenchuk on the banks of the Dnieper.

-

Moscow “Defaults” For First Time Since Bolshevik Revolution – Russia defaulted on about $100 million worth of interest payments after international sanctions prevented the government from paying bondholders in rubles. It marks the first foreign debt default since 1918. However, this should come with an asterisk, as Russia is willing and able to pay, but simply isn’t allowed to. Russian spokesman Dmitry Peskov scoffed that the alleged default is “not our problem.”

-

USA Boosts Troops In Eastern Europe – There are now more than 100,000 American troops in Europe, an increase of more than 30,000 since Russia launched its invasion of Ukraine. However, experts argue that European members of NATO must ultimately do more to contribute to the alliance, as America is stretched thin. It would be hard pressed to respond to any security crisis in the Pacific, especially anything involving China.

CUTTING EDGE: What‘s Happening In Tech

-

DC, NYC Out Of Monkeypox Vaccines – New vax just dropped. New York and Washington DC both made monkeypox vaccines available to high-risk populations, but both have apparently burned through their stores. The White House reports that about 300,000 new doses of the “Jynneos” vaccine should be available shortly.

-

Prime Day Comes Just Twice A Year – Amazon’s “Prime Day” just doesn’t have the cachet it used to have, so AMZN is doubling it up. “Prime Day” will hit July 12 and 13, but the company is planning another event for the fourth quarter. “The Prime Fall deal event is a prime-exclusive shopping event coming in Q4,” read a notice sent to third party sellers, telling them to get ready.

-

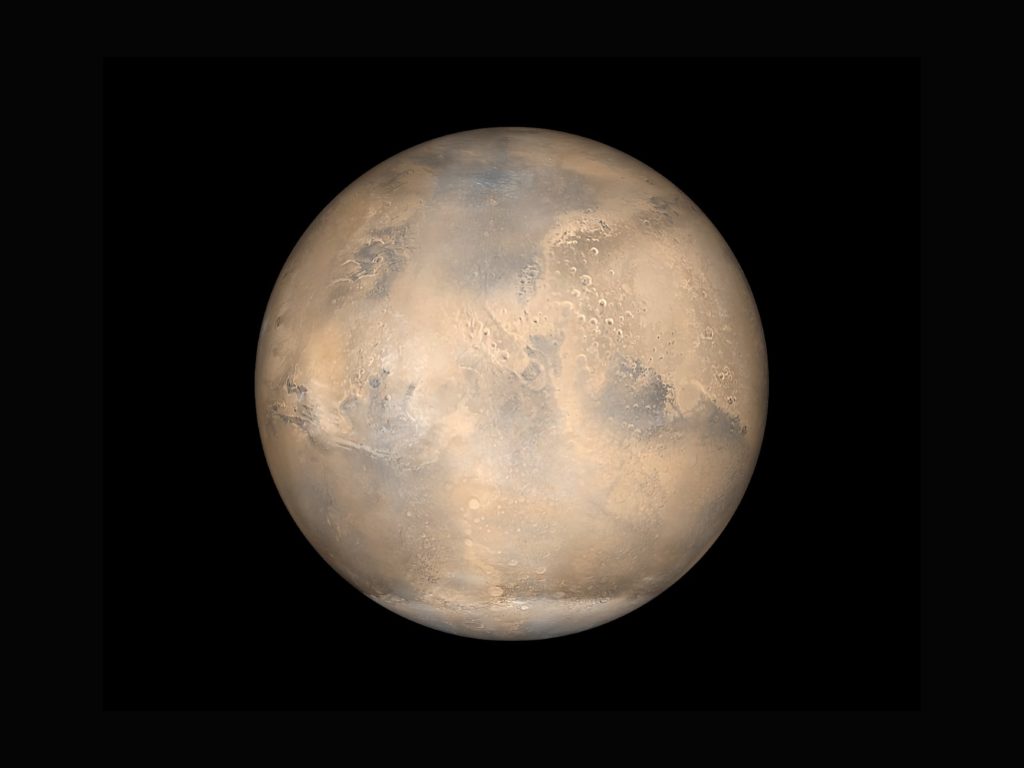

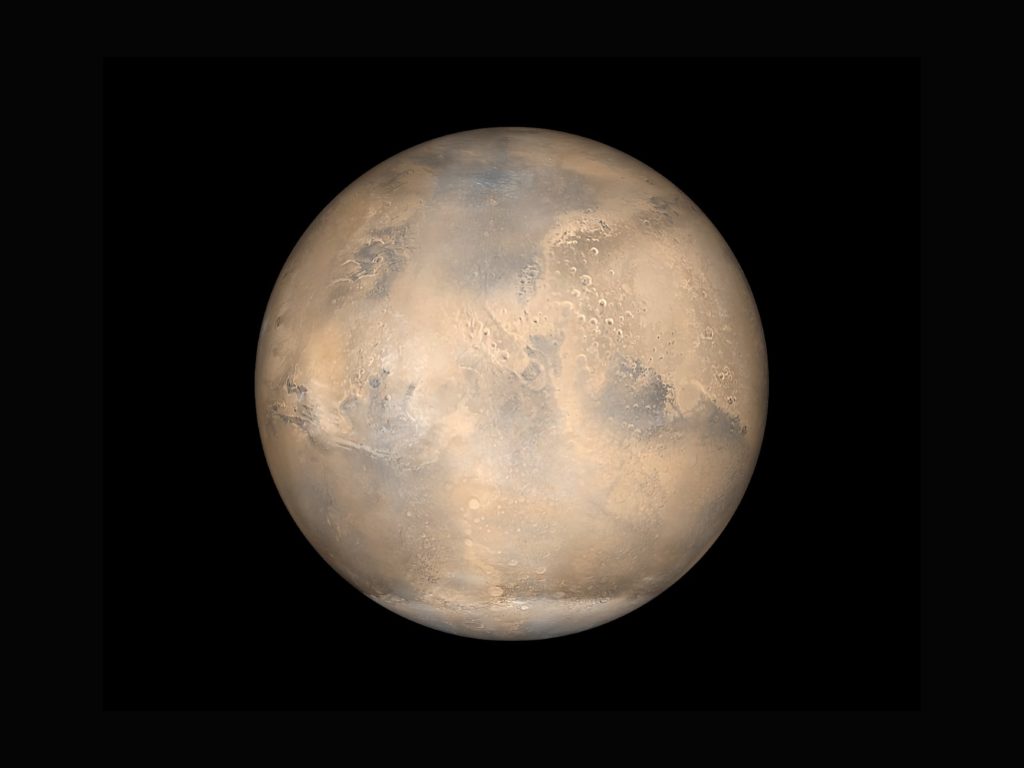

Mars Express Finally Gets Update From Windows 98 – We went to the moon using technology far less sophisticated than what’s in your cell phone. This isn’t quite as impressive, but it’s close. The Mars Express spacecraft, launched in 2003 and operated by the European Space Agency, is finally getting an update. Its Mars Advanced Radar for Subsurface and Ionospheric Sounding (MARSIS) software was based on Windows 1998 – and it’s been operating on that all this time. It’s finally getting an update. With this and Internet Explorer recently getting mercy-killed, it feels like we are finally making some progress.

FOR YOUR CONSIDERATION

“If you owe a bank a million dollars, you have a problem. If you owe a bank a billion dollars, the bank has a problem.”

Russia just “defaulted” on its debt. But it’s not for a lack of resources – it just isn’t allowed to pay. America’s sanctions program against Moscow has been effective… but it’s a massive gamble.

What happens as other powers grow uncomfortable with a nation like Russia being “canceled” from the world economy? And can European unity be maintained in the face of increasing energy costs? Mr. X explains why the entire monetary order is on the line in Ukraine – and why all investors need to be closely tracking an international organization called BRICS.

Don’t miss your geopolitical briefing in a dangerous world.

The information in this email is intended for informational purposes only and does not guarantee specific results as there is a high degree of risk involved with trading. Also, our traders are real traders and may have financial interests in the companies discussed. Please see our Terms and Conditions for more information