After a huge amount of buildup, it turns out the Fed WASN’T the big story yesterday.

The central bank hiked interest rates by three-quarters of a point, in line with expectations. Some were expecting a full point hike but that was never truly realistic.

Three-quarters is pushing it anyway, and as you can see below, there is already opposition.

However, the big story is that Senator Joe Manchin (D-WV) finally agreed with Senate Majority Leader Chuck Schumer on an important spending package.

The “Inflation Reduction Act” (no, stop laughing) will provide an estimated $369 billion for clean energy programs, as well as impose a 15% minimum corporate tax rate.

That could be enough to change the fortunes of many American energy companies… as well as the Democrats’ political fortunes in November.

Of course, today we’ll get the GDP figures… and after that, probably a ton of tedious arguments about whether or not we are in a recession.

Let’s be clear, as the politicians say. The country may be in a recession. We aren’t. Never have. Never will be.

Let’s get at it.

Keep Moving,

Any strategy that makes you money consistently is worthwhile.

Though many new traders believe that trading is primarily about indicators and tools, Chris maintains that it is at least 95% about emotional control.

This is especially relevant in this bearish, choppy market which has made the trading world extremely difficult.

Learn some pro tips to come back from your losses and stay in the game.

WORD ON THE STREET

Democrats Deal, GDP Intrigue, Fed Under Fire

- Suddenly, Manchin! – Yes, I will use the term “coming out of left field.” After repeatedly frustrating his own party’s legislative agenda this year, Senator Joe Manchin announced he agreed with the so-called “Inflation Reduction Act.” If passed, the law will have a massive impact, with $369 billion going to clean energy and climate change programs, an additional $124 billion going to the IRS for tax enforcement, and an end to the carried interest “loophole” for investors. The bill will also reduce prescription drug costs by allowing the federal government to negotiate prices.

-

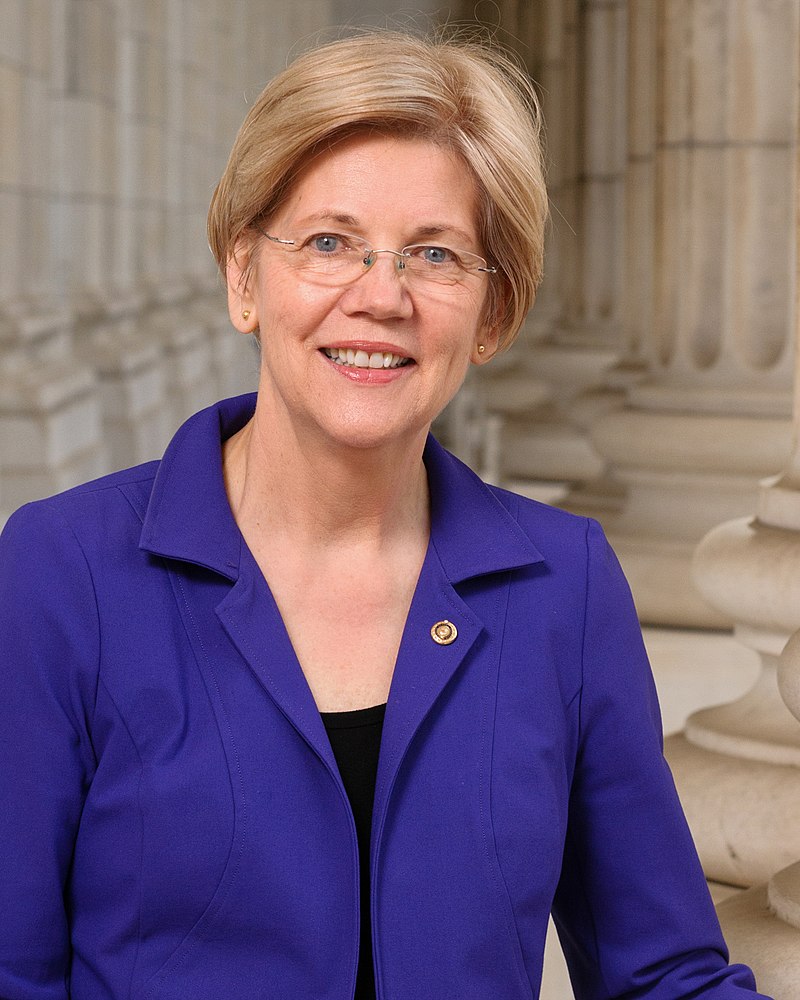

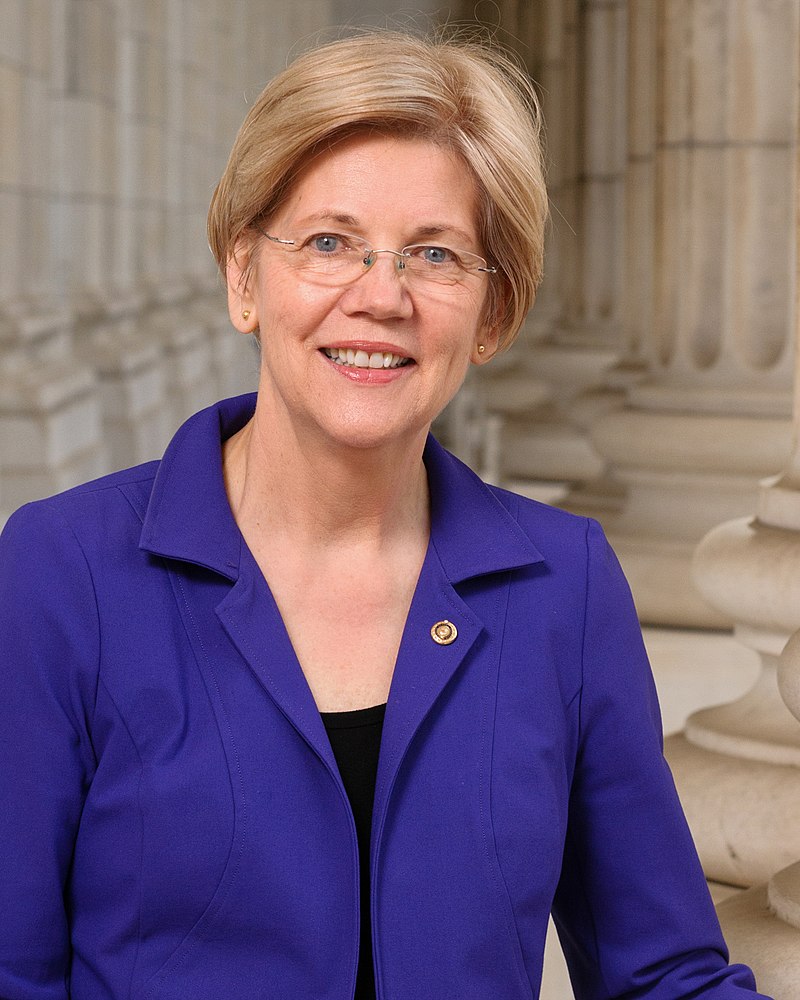

Warren On The Warpath – Senator Elizabeth Warren (D-Mass) has been extremely critical of the Federal Reserve’s aggressive strategy to confront inflation with massive interest rate hikes. “With Mr. [Jerome] Powell expected to announce another round of aggressive interest-rate hikes, the Fed risks triggering a devastating recession,” Senator Warren wrote earlier this week. The Fed didn’t back down yesterday, raising interest rates by another three-quarters of a point. Look for the populist senator to increase her criticism if we see reports of an economic slowdown today.

-

What’s In A Word? – Federal Reserve Chairman Jerome Powell said in his remarks yesterday that “I do not think the U.S. is currently in a recession and the reason is there are too many areas of the economy that are performing too well.” Attentive observers may see the obvious loophole there. Even if we get a report today that GDP has declined for another quarter, both the Fed and the Biden Administration could argue that the relatively strong jobs market means that the economy is not in a real recession. Economic news is going to be like modern philosophy – long, boring, and pointless debates over semantics. And they already called economics “the dismal science.” This is why I just stick to what stocks to pick.

-

Walmart Bounces Back – The market rallied yesterday after the Fed’s actions, and even some recent losers roared back. WMT was up almost 3.8% on news that it is cutting prices even further to clear out inventory. Other retailers advanced too – Costco Wholesale (COST) was up more than 2% and Tractor Supply gained almost 1.8%. Snapchat (SNAP), another recent loser that sparked a decline in the entire tech sector, was down on the day. Well, not everyone can come back.

HOT SPOTS: What’s Going on in Geopolitics

- Military Making Plans For Speaker Pelosi Visit – Speaker of the House Nancy Pelosi may be unable to back down from her planned visit to Taiwan, and that has the American military making plans. Joint Chiefs Chairman General Mark Milley vowed that the military would “do what is necessary” to protect the Speaker or any other American leader visiting the country. Speaker Pelosi is not expected to be traveling alone, with members of both parties reportedly joining her.

-

New Zealand To Be Renamed? – A parliamentary committee may be forced to consider a petition signed by more than 70,000 that could change the name of the country. New Zealand could be renamed to Aotearoa, a Māori term for the country. A compromise position may see the country renamed to a compound word, as in Aotearoa New Zealand.

-

New WNBA Trade – Brittney Griner For Arms Dealer – Secretary of State Antony Blinken has reportedly offered to trade convicted arms dealer Viktor Bout for WNBA star Brittney Griner, who is currently imprisoned in Russia on drug charges. Another jailed American, Paul Whelan, would also be part of the deal. Perhaps most importantly, the direct negotiations between the Secretary of State and his Russian counterpart would be the first high-level direct contact between Russia and the United States since the invasion of Ukraine.

CUTTING EDGE: What‘s Happening In Tech

- Pelosi’s Husband Takes A Bath On NVDA – Speaker of the House Nancy Pelosi’s husband Paul received heavy criticism when he bought millions worth of shares in Nvidia (NVDA) ahead of debate on a bill that would provide more support for chip production in the United States. On July 26, he sold 25,000 shares at a loss of about $341,365. I hope this was simply in response to criticism from the public. Otherwise, that’s more embarrassing than his recent DUI arrest.

-

Grim Milestone For Meta – Meta Platforms (META) posted its first ever decline in revenue. The Facebook parent company reported quarterly revenue of just $28.8 billion, down 1% from last year. Mark Zuckerberg blamed a larger economic downturn that is hurting the digital advertising space.

-

EV Stocks CRUSH IT After Senate Deal – Part of the Inflation Reduction Act includes restoring a tax credit for electric vehicles. As you might expect, this had a huge impact on car companies. Tesla (TSLA) rose by more than 6%, Ford (F) was up more than 5% during the trading day and more than 6% after-hours, and General Motors rose by 4%. Ford also beat earnings expectations, with the company crediting strong demand.

FOR YOUR CONSIDERATION

“When interest rates are low, these companies tend to do exceptionally well. Borrowed money aids in the research and development of new products and services which find eager buyers the moment they’re released. That isn’t currently the case.”

Chris Hood is a technical trader… but that doesn’t mean he’s blind to the opportunities revealed by fundamentals. And as he says, down markets can be a goldmine for investing.

Your Options Coach reveals some of the stocks that could be the foundation for your future success… and explains why it may be time to act now.

.